child tax credit for december 2021 amount

What Will be the. While the monthly Child Tax Credit payments have now come to an end in theory at least anyone who did not claim these payments will be able to receive the full amount of.

Brproud Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

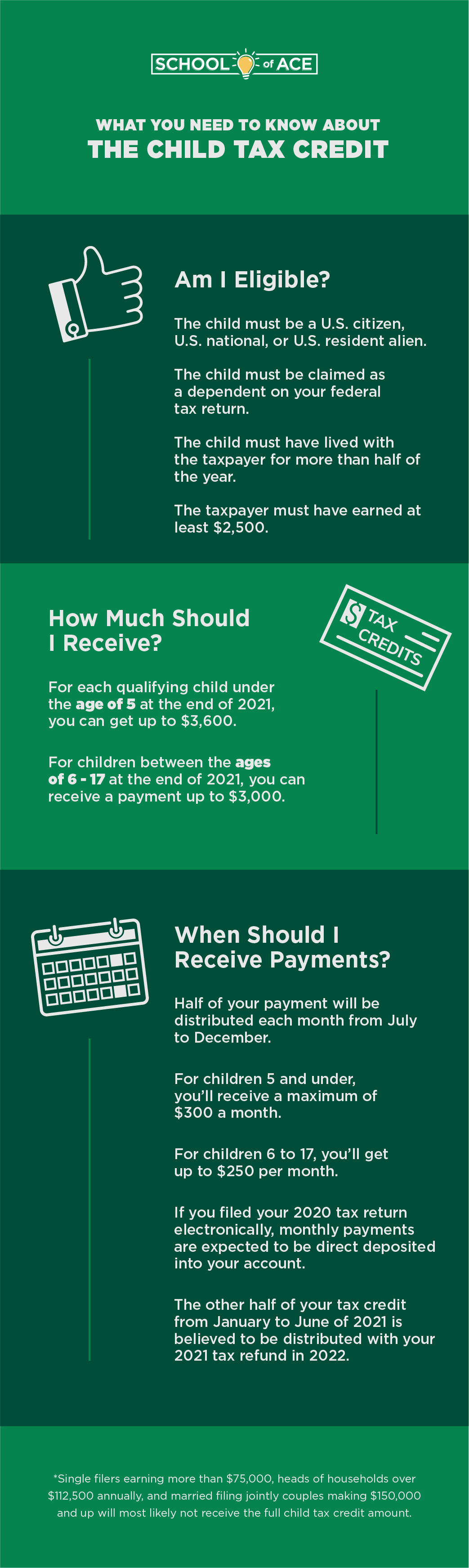

In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

. Lowers the phase out rate. 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic C. These monthly payments and want to get the full.

Child Tax Credit FAQs for Your 2021 Tax Return The IRS sent the sixth and final round of child tax credit payments to approximately 36 million families on December 15. The CTC amount will start to gradually decrease. The next child tax credit check goes out Monday November 15.

This means that the credit will revert to the previous amounts. For eligible families each payment is up to 300 per month for each child under age 6 and up to 250 per month for each child ages 6 through 17. The child tax credits are worth 3600 per child under six in 2021 3000 per child between six and 17 and 500 for college students aged up to 24.

For children under 6 the amount jumped to 3600. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for. However theyre automatically issued as monthly advance payments between July and December - worth up to 300 per child.

Here are more details on the. The credit amounts will increase for many. The Build Back Better Act extends the expanded Child Tax Credit which has been a game changer for working families.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying. The credit amount was increased for 2021. It helped roughly 60 million children and helped cut child.

First the credit amount was temporarily increased from 2000 per child to. The two most significant changes impact the credit amount and how parents receive the credit. Through December 2021.

The enhanced child tax credit was valid through the end of December 2021 which means that the limits and amounts will revert to the 2020 tax credit rules. Calculation of the 2021 Child Tax Credit Earned Income Tax Credit Businesses and Self. The Child Tax Credit will continue in 2022 just without the expanded measures from the American Rescue Plan.

The American Rescue Plan allowed for an increase in the Child Tax Credit for the 2021 tax year. Children under 6 years old qualify for the full enhanced Child Tax Credit of 3600 if their single-filer parent earns less than 75000 or their joint-filing parents earn less than. The American Rescue Plan Act ARPA of 2021 made important changes to the Child Tax Credit CTC for tax year 2021 only.

The IRS will send you monthly payments for half your new credit between July and December 2021.

First Month Without The Expanded Child Tax Credit Has Left Families In Distress Npr

Advance Child Tax Credit Tax Attorney Rjs Law San Diego

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

What You Need To Know About The Child Tax Credit

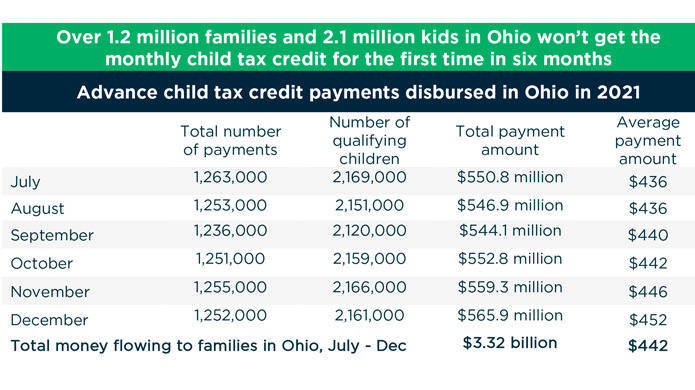

What S At Stake For Families As The Monthly Child Tax Credit Payment Ends Ohio Capital Journal

What Families Need To Know About The Ctc In 2022 Clasp

Child Tax Credit Helps Working Families Cut Child Poverty Monticello Central School District

Final Check Child Tax Credit Payment For December Youtube

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

New Child Tax Credit Explained When Will Monthly Payments Start Ktvb Com

A 3 600 Fourth Stimulus Is Coming For Millions Of Americans Jobcase

What Is The Child Tax Credit And How Much Of It Is Refundable

3 7 Million More Children In Poverty In Jan 2022 Without Monthly Child Tax Credit Columbia University Center On Poverty And Social Policy

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

December S Child Tax Credit Payment Is The Last One Unless Congress Acts Cnnpolitics

What You Need To Know About The Child Tax Credit Sunlight Tax

What To Know About The New Monthly Child Tax Credit Payments

December Child Tax Credit Why Some Parents Were Only Paid Half And What To Do If You Didn T Get It At All The Us Sun

Child Tax Credit Monthly Advance Payments To Start Arriving July 15